I do also think there can be many benefits to use additional strategies other than the SWOT strategy and the Grand strategy. For example, Apples product.Bcg Matrix Advantages And Disadvantages. Understand why a firm would want to use portfolio planning.The Boston Consulting Group (BCG) matrix is a visual marketing management tool used to analyse a firms product portfolio. BCG matrix is used to evaluate balance in the firm's current portfolio of Dogs, Question Mark, Cash Cows. BCG matrix can be used to determine and to identify how corporate cash resources can best be used in order to maximize company's profitability and future growth. Advantages of BCG Matrix are: BCG Matrix is simple and very easy to understand.

Advantages Of Bcg Matrix How To Allocate Resources

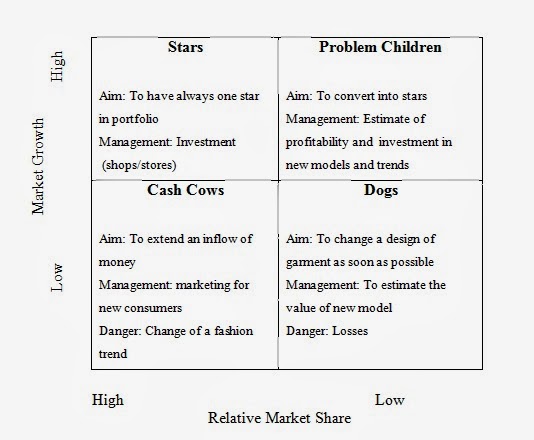

Using the matrix requires that each businesses unit owned by a firm be categorized along two dimensions: its share of the market and the growth rate of its industry. The Boston Consulting Group (BCG) MatrixThe Boston Consulting Group (BCG) matrix is the best-known approach to portfolio planning ( Figure 8.20 “The Boston Consulting Group (BCG) Matrix”). Portfolio planning first gained widespread attention in the 1970s, and it remains a popular tool among executives today. Portfolio planning is a process that helps executives assess their firms’ prospects for success within each of its industries, offers suggestions about what to do within each industry, and provides ideas for how to allocate resources across industries. Stars in the BCG matrix because they have a high market share but at the same time.Portfolio planning can be a useful tool.

Executives must decide whether to attempt to build these units into stars or to divest them. Finally, low-market-share units within fast-growing industries are called question marks. These units have bright prospects and thus are good candidates for growth and form the basis of the future success of the firm. High-market-share units within fast-growing industries are called stars. This is not to suggest that cash cows are not to be carefully managed to ensure that the maximum total profits are not “harvested,” just that investments decisions must be grounded in a different set of values for cash cows.Low-market-share units within slow-growing industries are called dogs. These units are good candidates for divestment because of the low return on investment in maintaining a market presence. Because their industries have bleak growth prospects, profits from cash cows should not be invested back into cash cows but rather diverted to more promising growth businesses.

...

Is market share a good dimension to use when analyzing the prospects of a business? Why or why not? Because this tool only deals with existing businesses, it cannot reveal what new industries a firm should consider entering. Third, portfolio planning does not help identify new opportunities.

The Growth Share Matrix or the Product Portfolio. The Experience Curve – Reviewed. Retrieved from The Boston Consulting Group, Inc.

Suggestions are then offered about how to approach each industry.Stars should be funded and encouraged to grow.Question marks should be resolved by executives by deciding whether to foster or sell these units.Cash cows should be “milked” to supply funds to more promising business.It sounds mean but dogs should be sold if possible and abandoned if necessary. The matrix categorizes businesses as high or low along two dimensions — the firm’s market share in each industry and the growth rate of each industry.

0 kommentar(er)

0 kommentar(er)